Vehicle/Bike Tax Rate In Nepal 2079/80 [2022-23]

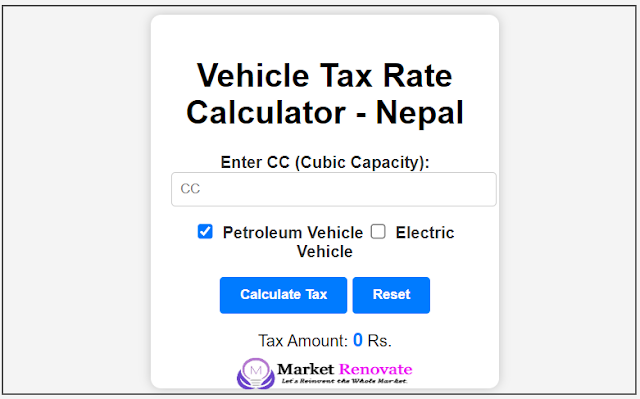

Nepal’s fiscal year 2079/80, which corresponds to 2022-23, has seen changes in tax rates for various vehicles and bikes. These tax rates are essential for both vehicle owners and those planning to purchase one. In this article, we’ll break down the tax rates for motorcycles/bikes and electric vehicles based on their engine capacity and wattage.

Motorcycle/Bike Tax Rate

Here are the tax rates for motorcycles and bikes in Nepal for the fiscal year 2079/80:

| Engine Capacity (CC) | Tax Amount (Rs.) |

|---|---|

| Up to 125 cc | 3,000 |

| 126 cc – 160 cc | 5,000 |

| 161 cc – 250 cc | 6,500 |

| 251 cc – 400 cc | 11,000 |

| 401 cc – 650 cc | 20,000 |

| Above 651 cc | 30,000 |

These tax rates are applicable to motorcycles and bikes based on their engine capacity. The higher the engine capacity, the higher the tax amount.

Electric Vehicles Tax Rate

Nepal is also making strides in promoting electric vehicles (EVs) with favorable tax rates. Here are the tax rates for electric vehicles in Nepal for the fiscal year 2079/80:

| Wattage | Tax Amount (Rs.) |

|---|---|

| 350 Watt to 1000 Watt | 2,000 |

| 1001 watt to 1500 watt | 2,500 |

| 1501 watt and higher | 3,000 |

Electric vehicles are categorized based on their wattage, and the tax rates vary accordingly. This incentivizes the use of electric vehicles, which are more eco-friendly and energy-efficient.

Importance of Understanding Tax Rates

Understanding the tax rates for vehicles and bikes is crucial for both vehicle buyers and existing owners. It helps individuals plan their budgets effectively and make informed decisions when purchasing a vehicle. Additionally, these tax rates contribute to the government’s revenue and play a role in shaping the country’s transport policies.

Conclusion

In the fiscal year 2079/80 [2022-23], Nepal has set tax rates for motorcycles/bikes and electric vehicles based on their engine capacity and wattage, respectively. These rates are important for individuals looking to buy vehicles and for those who already own them. By staying informed about these tax rates, people can make financial decisions that align with their needs and preferences.

Please note that these tax rates are subject to change, and it’s essential to verify the latest information from official government sources for the most up-to-date figures.

For official government documentation and announcements regarding vehicle tax rates in Nepal, you can refer to the Nepal Ministry of Finance.

This article provides an overview of the vehicle and bike tax rates in Nepal for the fiscal year 2079/80 [2022-23]. If you have any further questions or need more information, please feel free to ask.

Please leave your comments or ask your queries here. The comments shall be published only after the Admin approval.